On July 4th, an enormous tax and spending bill (“BBB”) was signed into law after passing through Congress via the reconciliation process and along partisan lines. The 887-page BBB features the largest cuts to social safety net programs in decades.

(And the White House is calling for more safety net cuts in the discretionary budget. But that’s a fight for another day.)

First, it’s important to underscore that this legislation will affect nonprofits and the people they serve in different stages, as this graphic from the New York Times shows:

But there’s a lot more in this legislation of relevance than just the above.

Below is our first look at the key provisions in the BBB that affect the nonprofit sector, with the caveat that the specific consequences could take months or years to determine.

Please note: We’ve gone into more detail on the Medicaid and other healthcare cuts, given their complexity and their sweeping implications for our sector.

Healthcare Cut by $1.1 Trillion

Summary: The BBB contains over $1 trillion in cuts to Medicaid, the largest cut in the program’s history. Overall, federal spending on Medicaid, Medicare, and the Affordable Care Act (ACA) will be reduced by more than $1.1 trillion by 2034. This will result in an estimated 11.8 million Americans losing insurance by 2034 according to the nonpartisan Congressional Budget Office. In total, due to the BBB and other federal policy changes, 17 million people are expected to lose health care coverage, according to an analysis from the Kaiser Family Foundation. This would represent the largest policy-driven rollback of health insurance coverage in history.

What will be the consequences for Ohioans? The Kaiser Family Foundation (KFF) had projected that the House version of the BBB would expel up to 500,000 Ohioans from Medicaid (a projection is still forthcoming on the final legislation). Financially, KFF estimates that Ohio will lose anywhere between $28 billion and $47 billion due to these Medicaid cuts.

Key details about the legislation: The BBB introduces a slough of changes to Medicaid and other healthcare programs. This breakdown from KFF is indispensable and comprehensive.

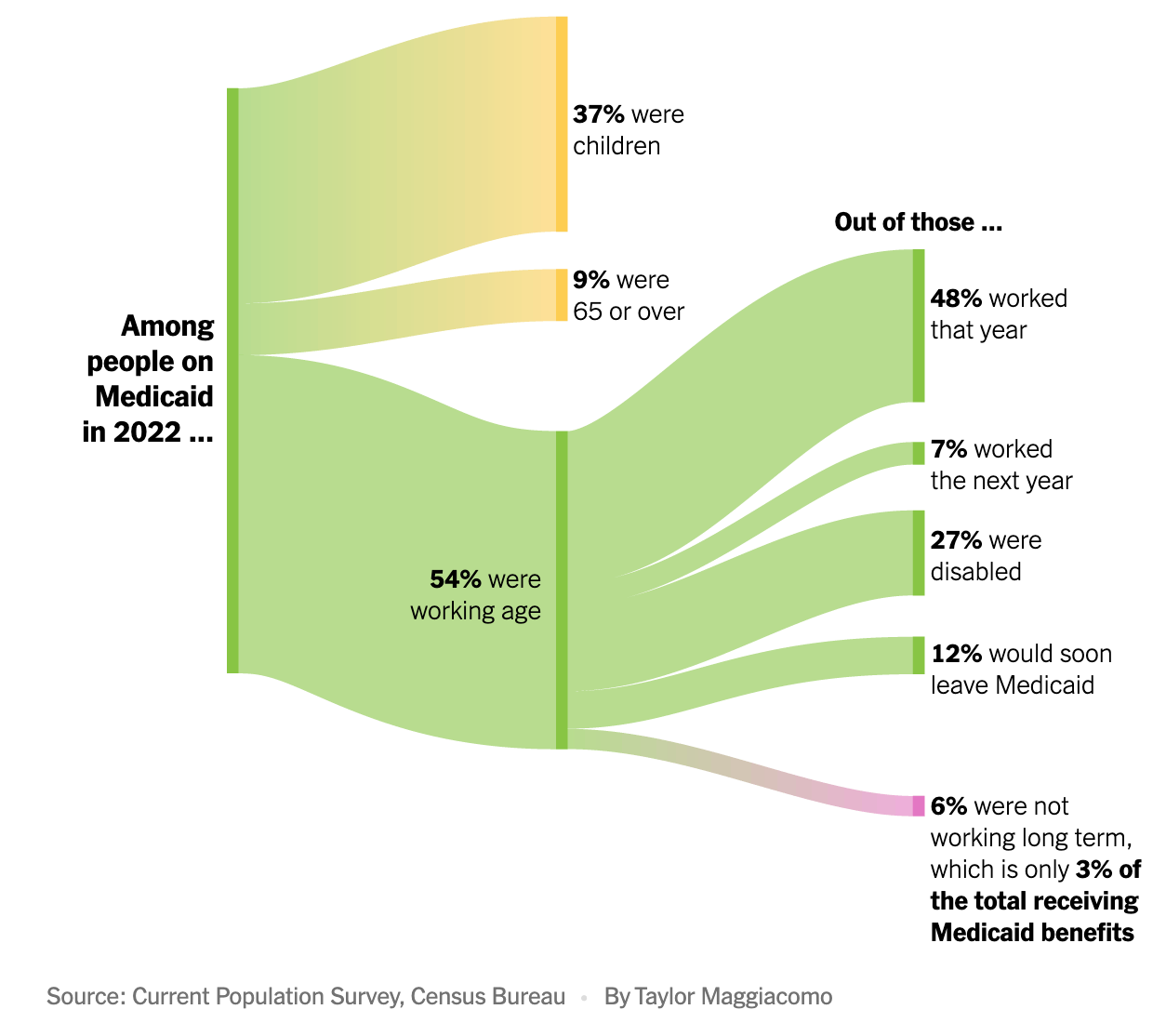

Work Requirements: The most notable change may be the restrictions on Medicaid aimed at reducing the number of participants, such as work requirements and more frequent eligibility checks. The BBB requires “able-bodied adults” to work 80 hours per month until age 65 to qualify, with exceptions for parents of children under 14 and those with disabilities. Here’s a breakdown of who was on Medicaid in 2022, for a frame of reference:

Immigrants and Healthcare Access: There has also been much attention around lawmakers’ attempts to remove healthcare access for immigrants through the BBB. First, for clarity: Undocumented immigrants have always been ineligible for federally funded Medicaid, Medicare, and subsidized private insurance through the Affordable Care Act (ACA) marketplaces. Unfortunately, the final legislation includes new restrictions on healthcare access for lawfully present immigrants. This breakdown from the National Immigration Law Center is thorough, but in sum: The legislation strips health coverage under the ACA marketplaces, Medicaid, and the Children’s Health Insurance Program for many lawfully present immigrants, including refugees, asylees, and those with other humanitarian protections. For more details, please see this breakdown from KFF.

Provider Tax Reduction: Another provision that has drawn lots of attention will affect 22 states—not including Ohio—by capping and reducing the taxes that states can impose on Medicaid providers. This has been a critical funding stream for hospitals in those states. (This is one of the reasons the American Hospital Association has adamantly opposed this legislation from the start.) The phase-out will begin in 2028, ultimately ending in a 3.5% cap.

Cost-Sharing: Lastly, there is a new $35 co-payment that can be charged to patients using Medicaid services, with notable exceptions including FQHCs, primary care, mental health, and substance use disorder services. This will not be effective until 2028.

Planned Parenthood Restriction: The BBB bars Planned Parenthood from receiving Medicaid funds for one year, though a federal judge has blocked this already.

Notably, all these healthcare restrictions come at the same time other changes are being made to the ACA Marketplace: The White House recently finalized ACA Marketplace integrity rules that would result in more people becoming uninsured, and later this year, enhanced premium tax credits are set to expire, leaving even more people uninsured. That’s why 17 million people are projected to lose healthcare access as a consequence of this legislation, as explained in this op-ed by KFF’s Larry Levitt.

It’s a lot of change that will be coming over the next four years. And as the American Hospital Association’s opposition to this legislation infers, the financial losses from the BBB will not only affect people, or affect traditional nonprofits serving those people, but hospitals as well.

The challenges for rural hospitals will be particularly steep. However, Congress acknowledged and responded to those challenges by creating a $50 billion fund to support rural hospitals that will be available for FY 2026 thru 2030. And as the National Rural Hospital Association noted, even that will “fall short of addressing” other problems with this legislation.

Frustratingly, no such funds were allocated for individuals, urban hospitals, or more pressingly, for traditional health and human services nonprofits, to offset the consequenes of the aforementioned cuts and restrictions.

SNAP Benefits Cut by $180 Billion

The BBB is making a seismic shift to who bears the cost of food stamps, shifting for the very first time the costs of the Supplemental Nutrition Assistance Program (SNAP) to states. In Ohio, the cost of these federal policy changes would be approximately $416 million, according to the Center for Community Solutions.

In terms of access, early estimates suggest around 5 million people could lose access to SNAP benefits nationwide. There are no projections available at this time for the number of Ohioans who will lose access to SNAP.

The BBB requires states to pay for SNAP based on a state’s SNAP error rates, or rather, how often states have paid SNAP recipients either too little or too much in benefits. The federal government will continue to fully fund SNAP for states that have an error payment rate below 6% beginning in 2028. States with error rates above 6% will have to cover 5% to 15% of the costs.

For context: Only one state has never had an error rate over 6% since 2003, when the current SNAP system began. And in 2024, only 7 states had error rates below 6%.

Ohio’s error rate was 9% in 2024.

Consequently, Ohio will be responsible for hundreds of millions each year in new spending just to maintain the SNAP benefits available now, which are inadequate as it is.

As Ohio Association of Foodbanks CEO Joree Novo has stated: “I’m not only concerned about access to affordable food for people with lower resources, but also sustainability and resilience in the food-supply sector as a whole.”

Furthermore, the BBB includes expanded requirements that able-bodied adults must continue to work up to age 64. It mandates parents of children ages 14 or older, people experiencing homelessness, former foster youth, and veterans to meet work requirements. Lastly, a range of lawfully present immigrants will be barred from receiving SNAP.

Lastly, the BBB increases the administrative costs for SNAP that states must bear. That alone creates a new $100 million cost for the State of Ohio.

Additional Provisions of Relevance to Nonprofits

Low-Income Housing Tax Credit

The BBB permanently increases 9% allocations for the Low-Income Housing Tax Credit by 12% starting in 2026. This is welcome news for nonprofits working to address the affordable housing shortage here and across the country, as these provisions could finance an estimated additional 1.22 million affordable homes by 2035.

Charitable Giving

The good news: The BBB includes a new universal charitable deduction to encourage charitable giving among the 90% of taxpayers who do not itemize their deductions. Under this provision, individuals could receive a tax incentive up to $1,000, and married couples could receive up to $2,000. This provision is estimated to generate $74 billion for nonprofit organizations over 10 years.

The bad news: The final tax package also includes several provisions that disincentivize charitable giving. (1) It decreases the value of the charitable deduction for high-income taxpayers by capping itemized deductions, (2) Sets a new 0.5% floor for the itemized charitable deduction, and (3) Creates a 1% floor for charitable contributions by corporations. These provisions are estimated to reduce resources for nonprofits by at least $81 billion over 10 years.

Immigration

The BBB provides $170 billion for immigration and border enforcement, including $30 billion for ICE’s enforcement and deportation operations.

Child Tax credit

The BBB increases the annual child tax credit to $2,200. For parents filing a joint tax return, only one parent would need to have a Social Security number.

Student Loans

The BBB restricts the options for students to pay back loans, with less flexibility on repayment, and a $200,000 federal student loan limit.

New borrowers who take out student loans after July 1, 2026, will have two options: (1) A new standard plan with fixed monthly payments or (2) An income-driven repayment plan, called the Repayment Assistance Plan, with variable monthly payments.

Additionally, only full-time students will be eligible for Pell Grants going forward.

Clean Energy

The BBB eliminates the clean energy tax credits approved in the 2022 Inflation Reduction Act, including a last-minute total repeal of federal subsidies to wind and solar industries unless the projects are placed in service before the end of 2027. It also ends the Greenhouse Gas Reduction Fund, which provides funding for nonprofit organizations that finance projects aimed at reducing greenhouse gas emissions in communities. Existing contracts and grants under the program will remain unchanged.

State and local tax deduction (SALT)

The package includes an increase to the cap on the state and local tax deduction, raising it from $10,000 to $40,000. This provision allows people to deduct up to $40,000 per year for five years from their federal taxes. The SALT deduction will phase out once an individual’s income hits $500,000. After five years, the cap goes back to $10,000. Before the rule, taxpayers could deduct all their state and local taxes from their federal taxes.

~

To help the people you employ and serve understand the impact of this legislation, The New York Times has published this useful tool. This individualizes the impact of this legislation, whose scale of projected negative consequences on the social safety net has no precedent.

We will continue working with our members in the months ahead to better understand the implications of this legislation as its ramifications become clearer, and to support nonprofits in meeting the needs of the people they serve.

A few thoughts on the BBB. Boring, not Beautiful, yet I approve with the Naughty by Nature Stamp.

https://torrancestephensphd.substack.com/p/you-down-with-bbb-yeah-you-know-me